Our clients often come to us with unique cases and concerns, especially in terms of navigating the eligibility differences between SSI and SSDI. We’ll take a deeper look at the two benefits and how they differ; but first, it’s important to understand the purpose and intent of the Social Security Administration and how they manage both programs.

Overview of the Social Security Administration

The Social Security Administration was created by President Franklin D. Roosevelt in 1935.The SSA has been providing financial protection for Americans for over 80 years. As of 2019, about 64 million Americans, including retired workers, disabled workers and survivors, receive over one trillion dollars in social security benefits annually. This represents approximately 16% of all government spending.

The agency is funded through Federal Insurance Contributions Tax (FICA), which is a dedicated payroll tax you and your employer each pay 6.2% of your wages into, up to the taxable maximum income of $137,700 annually. In 2018, $885 billion went into social security with another $83 billion earned from interest.

President Roosevelt created the agency in 1935 primarily as a federal safety net for elderly, unemployed and disadvantaged Americans. His primary hope was that the agency would prevent senior citizens from becoming impoverished. The program was based on the principle that individuals would pay a payroll tax over the course of their lifetime and these contributions would then be a reimbursed financial benefit for when they retired.

The Social Security Administration has changed dramatically over time, primarily by offering additional, better programs. The initial primary program was the federal “Old Age retirement Survivors and Disability Insurance” program or OASDI. The most significant modifications include “Temporary Assistance for Needy Families” (TANF), the addition of health insurance for aged and disabled (Medicare), grants to states for medical assistance programs for low income citizens (Medicaid), the “State Children’s Health Insurance Program” (SCHIP), and finally SSI or Supplemental Security Insurance, which was added in 1972.

OASDI versus SSI

It’s important to understand the difference between OASDI (commonly referred to as Social Security) and SSI in order to better understand the difference between SSI and SSDI. SSDI is the “D” in OASDI – Disability Insurance. 64 million Americans receive Social Security payments while only approximately 10 million Americans receive SSDI benefits, of which the majority were disabled workers (86% were disabled workers, 11% were disabled adult children and 3% were disabled widow(er)s). It’s important to also note that over 61 million Americans, or 1 in 4, are disabled, but most either do not meet the income requirements or have not applied.

SSI Overview

SSI eligibility is a “means based” program. It isn’t based on your work history but rather your financial need. As a needs based program there are strict income limits in order to qualify. For adults the income limit is $733 per month for an individual or $1,033 per month for a couple.

In order to be eligible to receive SSI benefits an individual must prove the following:

- That they are 65 + years of age or blind or disabled.

- They legally reside in 1 of the 50 States or are the child of military parents assigned a prominent duty outside the US.

- They have income and resources within certain limits.

- They have applied for the benefit.

SSI was created by Congress in 1972 with the goal of replacing a complex system of federal grants which were being paid to states to support the aged, blind or disabled. SSI is not funded from federal income tax. It is paid for through the US Treasury general fund. Currently the program pays benefits to approximately 8 million. The current monthly maximum federal payment is $783 for an eligible individual or $1175 for an eligible individual with an eligible spouse. The uniform monthly benefit is set by the federal government and then supplemented by some states. It also offers no family benefits. It’s important to note that those who are eligible for SSI are also eligible for Medicaid.

In addition, an individual’s resources must be below a certain limit. This amount is $2,000 for an individual and $3,000 for an individual and spouse. Resources are generally defined as savings in a bank, cash, stocks or bonds, a second vehicle or a second house.

Many people who are eligible for SSI may also be entitled to Social Security benefits. In fact, the application for SSI is also an application for Social Security benefits. However, SSI and Social Security are different in many ways.

The Social Security Administration lists the following differences:

- Social Security benefits may be paid to you and certain members of your family if you are “insured,” meaning you worked long enough and paid Social Security taxes. Unlike Social Security benefits, SSI benefits are not based on your prior work or a family member’s prior work history.

- In most states, SSI recipients may also receive medical assistance (Medicaid) to pay for hospital stays, doctor bills, prescription drugs, and other health costs.

- Many states also provide a supplemental payment to certain SSI recipients.

- SSI recipients may be eligible for food assistance. In some states, an application for SSI also serves as an application for food assistance.

- SSI benefits are paid on the first of the month.

- To get SSI, you must be disabled, blind, or at least 65 years old and have “limited” income and resources.

- In addition, to obtain SSI, you must also reside in the United States or the Northern Mariana Islands; not be absent from the country for a full calendar month or more, or for 30 consecutive days or more; and be either a U.S. citizen or national, or in one of certain categories of qualified non–citizens.

SSDI Overview

OASDI is funded through “worker’s contributions,” specifically by payroll taxes. You have to have worked, or an eligible spouse or parent has to have worked and contributed. It requires you to have no income or resource restrictions, it is a monthly benefit based on lifetime earnings and that benefit can be paid to eligible family members. It also qualifies you to be eligible for Medicare at age 65 or 2.5 years after your entitlement to disability benefits.

SSDI was not part of the initial Social Security Administration program that began in 1935. It was implemented more than 20 years later in 1956 by president Dwight D. Eisenhower. The program was initially established to bridge monthly benefits only to disabled workers between the ages of 50 and 65.

Social security disability insurance is a monthly payment which is offered to workers who are no longer able to work due to a significant illness or impairment that is expected to last at least a year or result in death within a year. The benefits are paid based on the disabled workers past earnings and are paid either to the disabled worker or to his or her dependent family members.

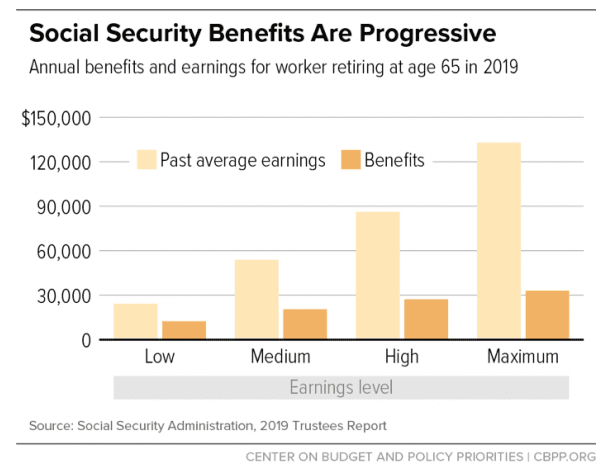

The amount of your disability benefit is based upon your average lifetime earnings and is weighted. If your average lifetime earnings were $20,000, your annual benefit would be $12,200, or 61% of your previous earnings. If you made the taxable maximum amount which was $127,000, your annual benefit would be $33,000, which is 26% of your previous earnings. The following chart helps describe this:

The requirements to be considered disabled are very strict. The law states that an applicant must be unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or which has lasted or is expected to last for a continuous period of at least 12 months. If the person has the ability to work and they earn more than $1,170 a month, they would not be eligible for disabled worker benefits.

The most important thing to understand is that SSI and SSDI are not mutually exclusive, meaning you may be eligible to receive both at the same time. We understand this is a lot of information to take in, and navigating SSI and SSDI cases is complicated. We’re here to help. Marken Law Group will evaluate your unique case and fight for your benefits.

Call 509-879-4626 for your free consultation. No fee unless you get benefits!